In an era which new technology evolves dramatically day by day and the human society becoming even more complex, the way and mean to calculate corporate evaluations are changing, evolving and becoming more diverse. At astamuse, we provide investment information and scoring by using our unique and independent method, assessing the value of a company based on future projections expected growth derived from our analysis using our proprietary database.

Our database for intangible asset visualization and the versatility analysis platform investment information

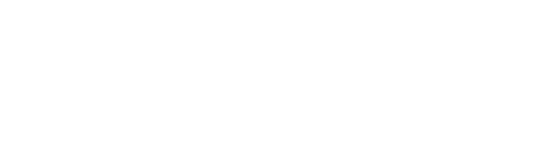

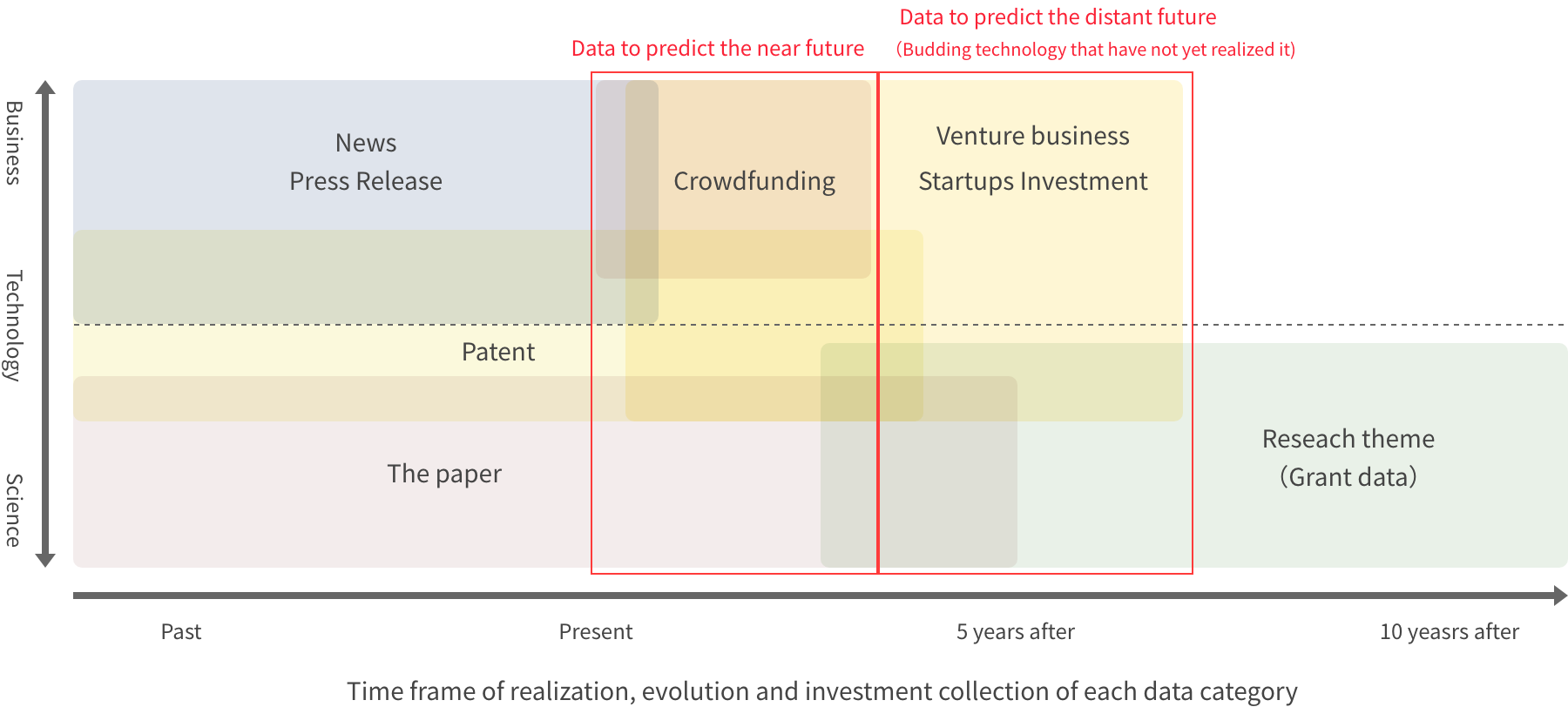

astamuse develops and expands a variety of data on technologies from the research stage through to commercialization and business based on public information, and conducts independent classification and research by our analysts team.

The data of investments, including Crowdfunding, venture capital, startup, grant and corporate investments, in the world enables us to analyze new business models, create new business concepts, and forecast the future over a wide range of periods.

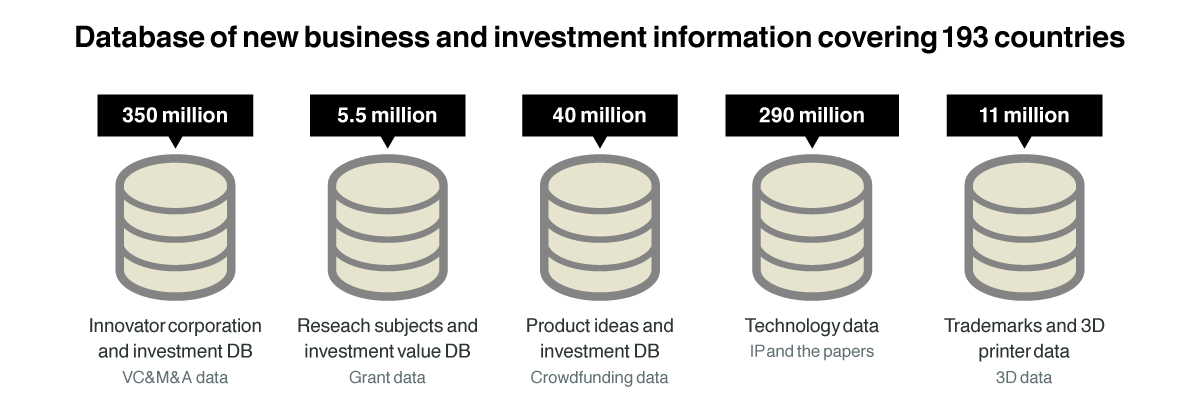

Data Pipeline

Our unique “intangible asset visualization database” and “versatility analysis platform” are the source of the one and only corporate value.

Providing various analysis and investment information

astamuse's solution combines approximately 700 million innovation capital data from 193 countries around the world to provide analysis and investment information tailored to your needs, including the valuation of intangible assets and the timing of investment returns.

Numerous high-dimensional analyses produced from the versatility analysis platform

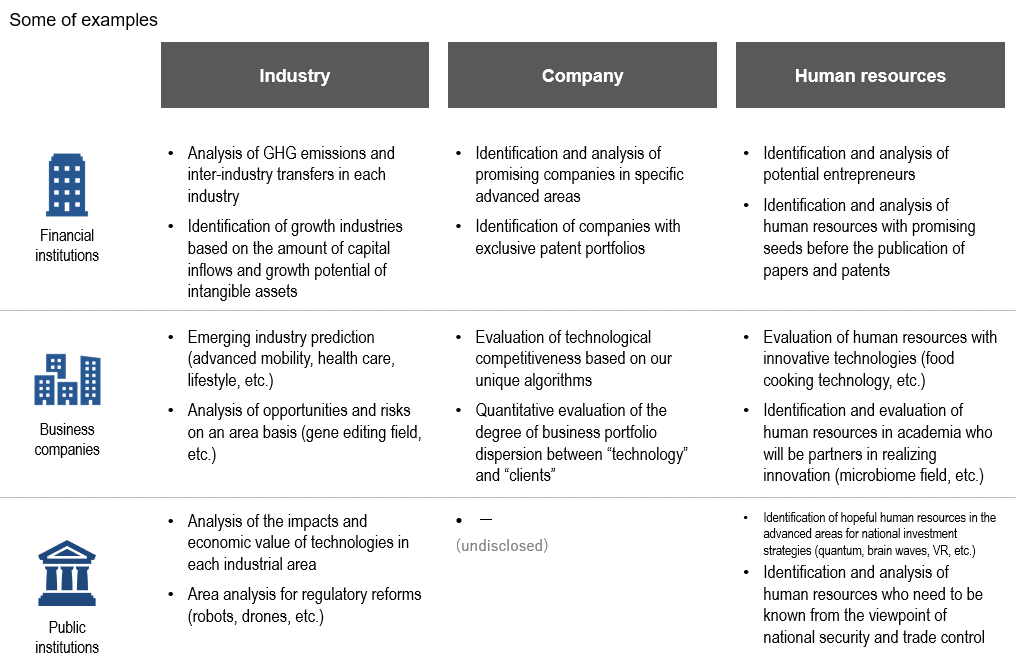

Our unique algorithms mechanically derive output using three units of analysis: industry, company, and human resources.

Corporate Valuation and Scoring

From the days when tangible assets such as real estate(factories and buildings), machinery, and product outputs were used for corporate evaluation, we are now in an era which "intangible assets" such as intellectual properties as well as proprietary data have become the core indicators for measuring corporate value due to the evolution of technology.

At astamuse, we use intangible core aspects for corporate evaluation which back in the days were difficult to measure, such as "human resource" "knowledge properties" and "networks and connections,". These aspects are the new key core evaluation indicators, and we use a variety of parameters through data-driven analysis to evaluate corporate values.

Example of Scores

- Patent Impact Score

- Total Patent Asset

- Innovation Efficiency Indicators

- Business Portfolio Score

- Materiality Score

- Sustainability Score

- ESG Score

- Carbon Reduction Impact Score